Investors, Here’s Who’s Gone Public in the Second Semester of 2020

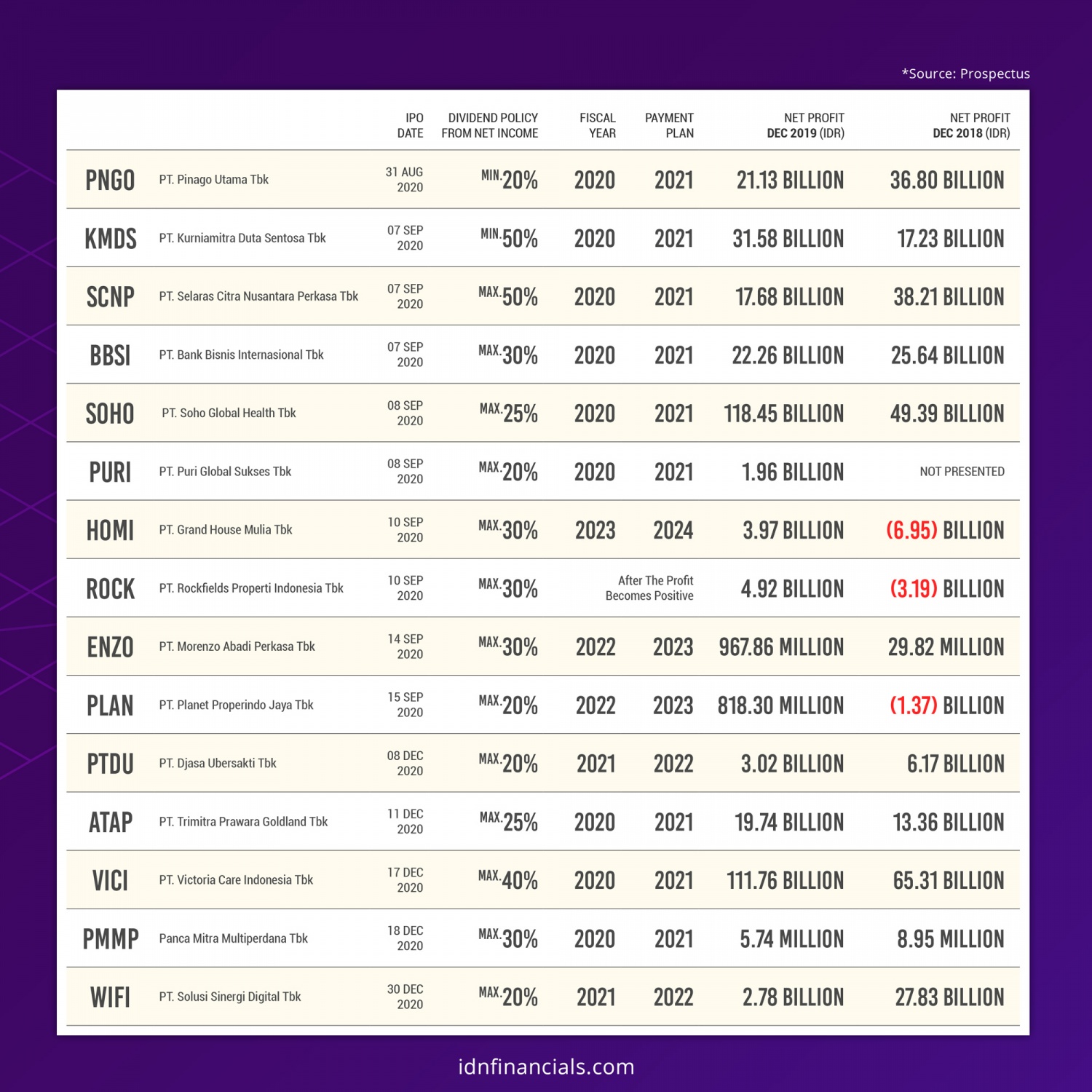

In the middle of the global pandemic, 2020 turned out to be a great year for companies to go public. Twenty-three companies went IPO in the second semester only, with two companies that offered a 50% payout ratio. Most companies offered a 20-30% dividend policy from net income and only one company offered as little as 10%.

PT Kurniamitra Duta Sentosa Tbk (KMDS) held the highest payout ratio this semester with a minimum of 50% of their net income. This company has been established for more than twenty years in Food and Beverages industry, but just decided to go public in 2020. They are known for their premium beverages’ products, such as Monin syrups, Lavazza coffee beans, and various dairy products under the Milklab brand. This company also recorded an 83% increase in net income from December 2018 to December 2019, amounting to Rp31.58 billion. They released 160 million shares with an initial offer of Rp300/share.

Another company that offered a 50% payout ratio was PT Selaras Citra Nusantara Perkasa (SCNP), a company that prides itself on consistently produces quality household appliance products and medical equipment. However, this company reported a 64% decrease in their 2019 net income, at only Rp17.6 billion. They released 500 million shares to market with an initial price of Rp110/share.

PT Victoria Care Indonesia (VICI) is next on the list with a 40% payout ratio to offer to investors. This company produces well-known cosmetics and body care brands, such as Miranda, Herborist, Nuface, and Victoria Fragrance. This company showed a significant increase in net profit in 2019, amounting to Rp111.76 billion or 71% higher than the previous year.

Among 23 companies that went IPO in the second semester of 2020, nine companies offered a 30% payout ratio. However, only 5 companies reported net profit increase in 2019: PT Boston Furniture Industries Tbk (SOFA), PT Transkon Jaya Tbk (TRJA), PT Grand House Mulia (HOMI), PT Rockfield's Property Indonesia (ROCK), and PT Morenzo Abadi Perkasa (ENZO). Two companies that reported a significant increase were Rockfield's Property Indonesia (Rp4.92 billion in 2019, from Rp -3.19 billion in 2018) and PT Grand House Mulia (Rp3.97 billion in 2019, from Rp -6.95 billion in 2018).

Interestingly, three companies offered a 25% payout ratio and all of them showed remarkable growth in net income. The highest increase was recorded by PT Soho Global Health Tbk (SOHO) with almost 140% at Rp118.45 billion in 2019. The second was PT Sunindo Adipersada Tbk (TOYS) with a 160% increase of net profit amounting to Rp11.24 billion in 2019. The last one is PT Trimitra Prawara Goldland Tbk (ATAP) which recorded almost 50% net profit growth amounting to Rp19.74 billion.

Seven companies on the list decided to offer a 20% payout ratio, but only PT. Sumber Global Energy Tbk (SGER) showed a sizeable net profit increase at Rp21.69 billion or a 70% increase from the previous year. PT. Puri Global Sukses Tbk (PURI) reported Rp11.96 billion net profit in 2019, but there’s no record to compare in 2018.

The only company with a 10% payout ratio this semester was PT. Megalestari Epack Sentosaraya Tbk (EPAC). Although offering the least pay-out ratio, the company that provides customized high-quality packaging reported a 100% net profit increase in 2019 at Rp2.54 billion. (KD)