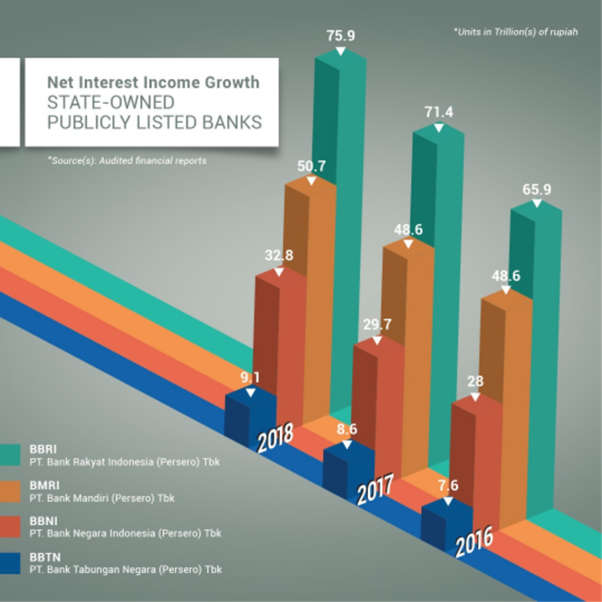

State-owned Banks Reported Net Interest Income - Who Shows the Highest Growth?

Four state owned banks are publicly listed in Indonesia: Bank Rakyat Indonesia (BBRI), Bank Mandiri (BMRI), Bank Negara Indonesia (BBNI), and Bank Tabungan Negara (BBTN). From 2016 to 2018, BRI recorded the highest rise in net interest income (NII) consecutively, while BTN reported the lowest rise. Overall, the order from the highest to the lowest was relatively the same during these years: BRI, Bank Mandiri, BNI, and BTN.

In 2017, BRI recorded an Rp71.4 trillion or 8.35% rise in net interest income from the previous year. Accordingly, BNI was next with Rp29.7 trillion or just slightly over 6% growth. BTN showed the highest percentage of net interest income increase at 13% amounting to Rp1 trillion. Bank Mandiri reported stagnancy, although being the bank with the second-largest net interest income at Rp48.6 trillion, as there’s no escalation from the previous year’s amount.

Subsequently in 2018, BRI still held the top position with Rp75.9 trillion of net interest income, escalating 4.5% from 2017. Bank Mandiri was next on the list as they recorded Rp50.7 trillion, showing a 4.32%. growth. BNI also reported significant growth of 10% at Rp32.8 trillion. Meanwhile, BTN reported an almost 6% rise in net interest income at Rp9.1 trillion this year. (KD)