Billions of Vale Indonesia (INCO) shares traded by major investors

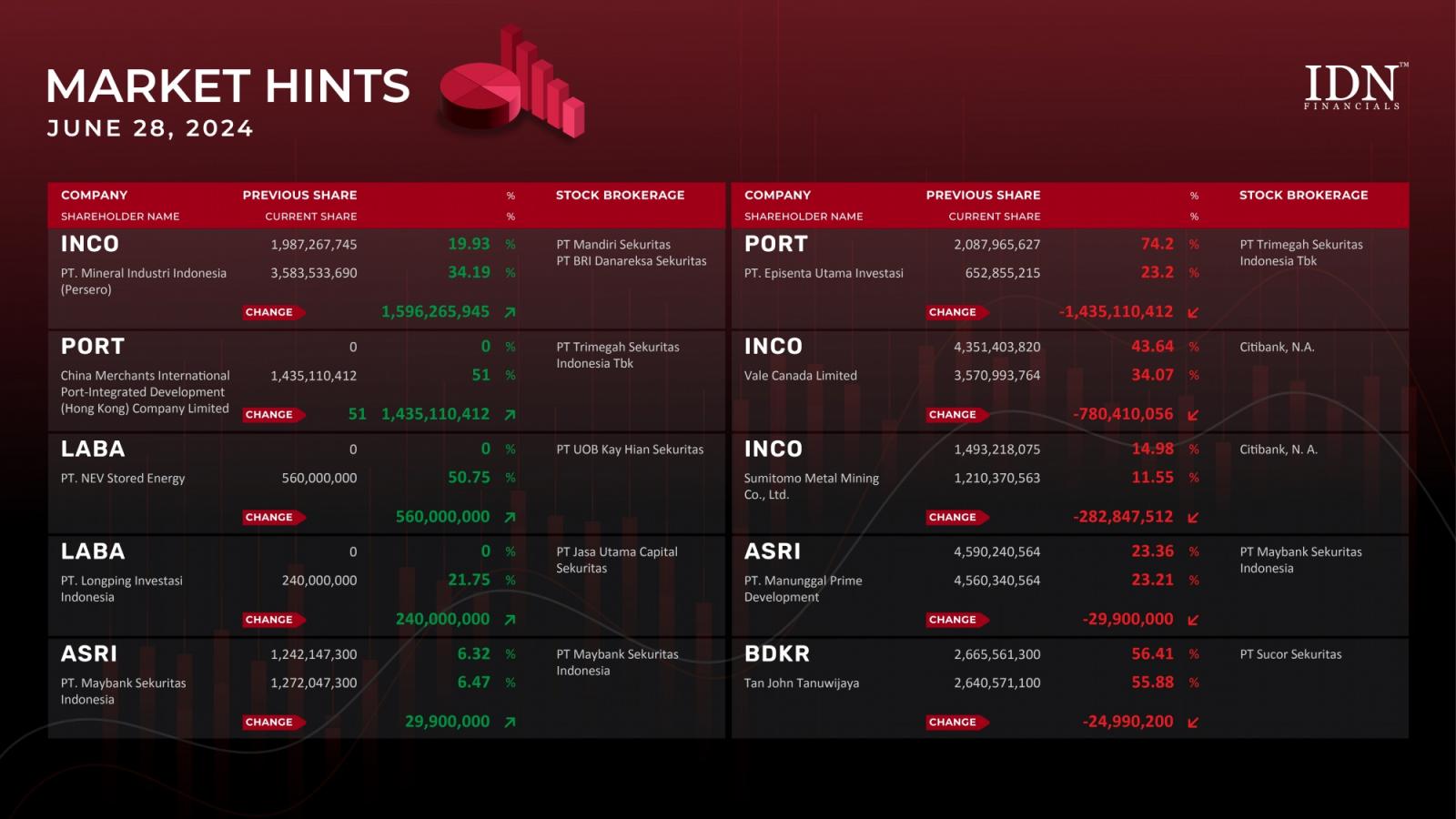

JAKARTA - At the end of June, several of PT Vale Indonesia Tbk's (INCO) major investors appeared to be trading billions of shares. On Friday, June 28, PT Mineral Industri Indonesia (Persero), a state-owned company, acquired 1.59 billion shares of the nickel mining company, increasing its ownership from 19.93% to 34.19%. However, INCO's controlling shareholder, Vale Canada Limited, reduced its shares by 780.41 million, followed by Sumitomo Metal Mining Co., Ltd., which sold 282.84 million. These two foreign investors reported remaining ownership of 34.07% in Vale Canada and 11.55% in Sumitomo Metal, respectively.

The following update came from PT Nusantara Pelabuhan Handal Tbk (PORT). A foreign investor named China Merchants International Port-Integrated Development (Hong Kong) Company Limited recently headed to this port services issuer and acquired 51% ownership. This control was granted after China Merchants purchased 1.43 billion shares of PORT. The shares were released by PT Episenta Utama Investasi, which previously owned 74.2% of PORT. Episenta currently controls only 23.2%.

PT Ladangbaja Murni Tbk (LABA), which produces and trades steel, also welcomed two major investors this time. Following the purchase of 560 million shares, PT NEV Stored Energy immediately gained 50.75% control of LABA. Aside from that, PT Longping Investasi Indonesia purchased 240 million shares, giving it an immediate 21.75% stake.

PT Alam Sutera Realty Tbk (ASRI), an integrated property development company, also recorded share sales and purchases totaling 29.90 million shares. PT Maybank Sekuritas Indonesia was seen selling these ASRI shares, which were quickly acquired by PT Manunggal Prime Development. Finally, Tan John Tanuwijaya remained in the market hints this time, selling 24.99 million shares of PT Berdikari Pondasi Perkasa Tbk (BDKR). (KD)

The best market news and hints are only at IDNFinancials!