In October, three issuers will pay bonds totaling over one trillion Rupiah

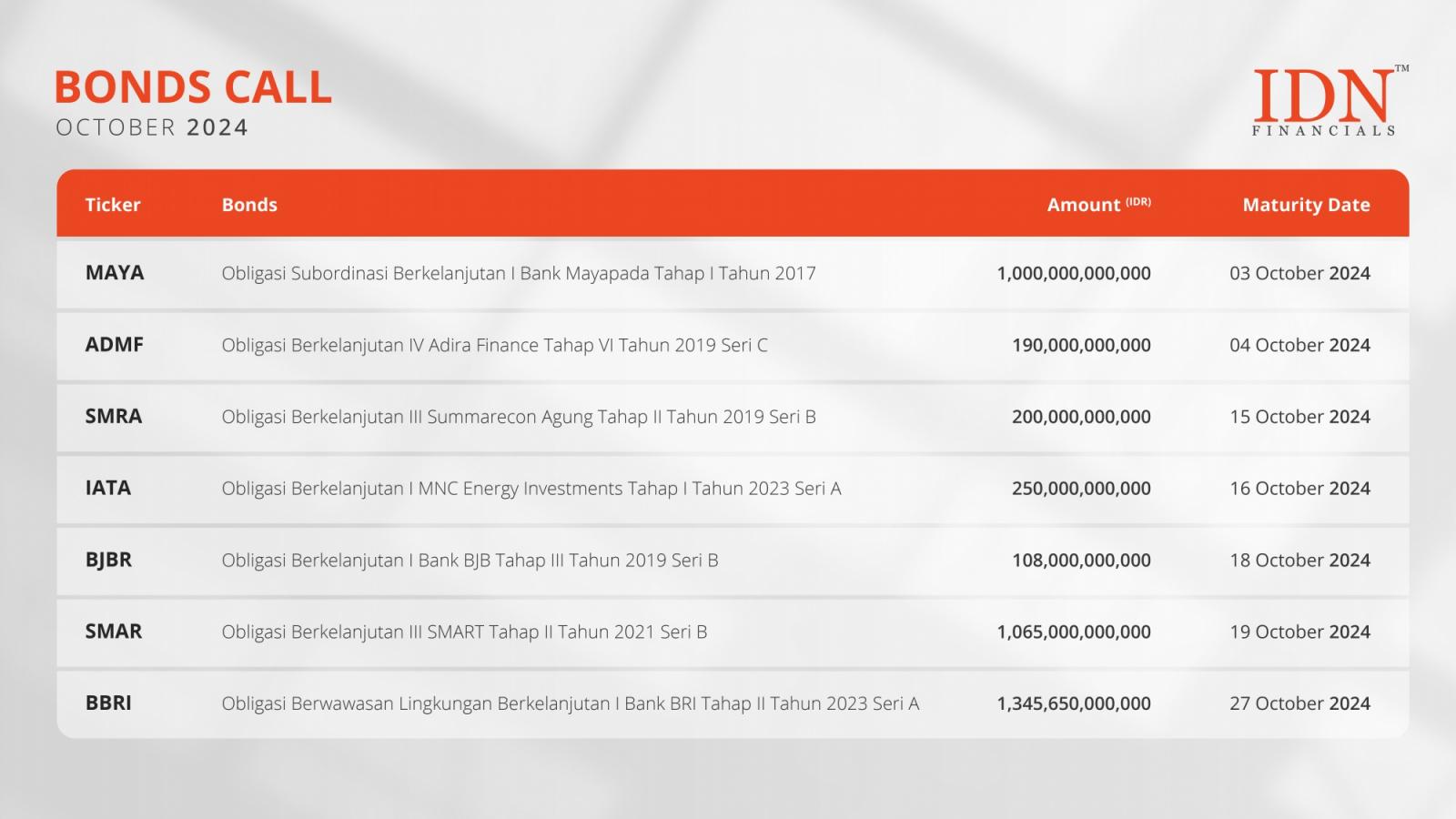

JAKARTA - Seven bonds from seven different issuers will mature in October. It's interesting to note that three of the issuers are listed as going to pay bonds worth over IDR 1 trillion or more.

By paying IDR 1 trillion for its Obligasi Subordinasi Berkelanjutan I Bank Mayapada Tahap I Tahun 2017, private bank PT Bank Mayapada Internasional Tbk (MAYA) initiates the bond call on October 3. The following day is the maturity date of PT Adira Dinamika Multi Finance Tbk's (ADMF) Obligasi Berkelanjutan IV Adira Finance Tahap VI Tahun 2019 Seri C, which has a payment value of IDR 190 billion. Adira is one of Indonesia's top auto financing providers.

PT Summarecon Agung Tbk (SMRA), the issuer involved in property development and management, then has to distribute funds totaling IDR 200 billion in the middle of the month on October 15 to settle its investors' payables for the Obligasi Berkelanjutan III Summarecon Agung Tahap II Tahun 2019 Seri B. A mere day from that, PT MNC Energy Investments Tbk (IATA)'s Obligasi Berkelanjutan I MNC Energy Investments Tahap I Tahun 2023 Seri A will mature, requiring the energy investment company also to disburse funds totaling IDR 250 billion.

The banking company PT Bank Pembangunan Daerah Jawa Barat and Banten Tbk (BJBR) will need to pay Rp 108 billion to the Obligasi Berkelanjutan I Bank BJB Tahap III Tahun 2019 Seri B during the same week, on the 18 October to be precise. The following day, the palm oil company PT Sinar Mas Agro Resources and Technology Tbk (SMAR) will pay the Obligasi Berkelanjutan III SMART Tahap II Tahun 2021 Seri B with an incredible nominal amount of Rp 1.06 trillion.

Last but not least, the Obligasi Berwawasan Lingkungan Berkelanjutan I Bank BRI Tahap II Tahun 2023 Seri A, with the highest total value this period reaching Rp 1.34 trillion, is scheduled to be paid by the national banking company, PT Bank Rakyat Indonesia (Persero) Tbk (BBRI). The due date for this payment is October 27. (KD)

You can read the most recent bond calls on IDNFinancials!