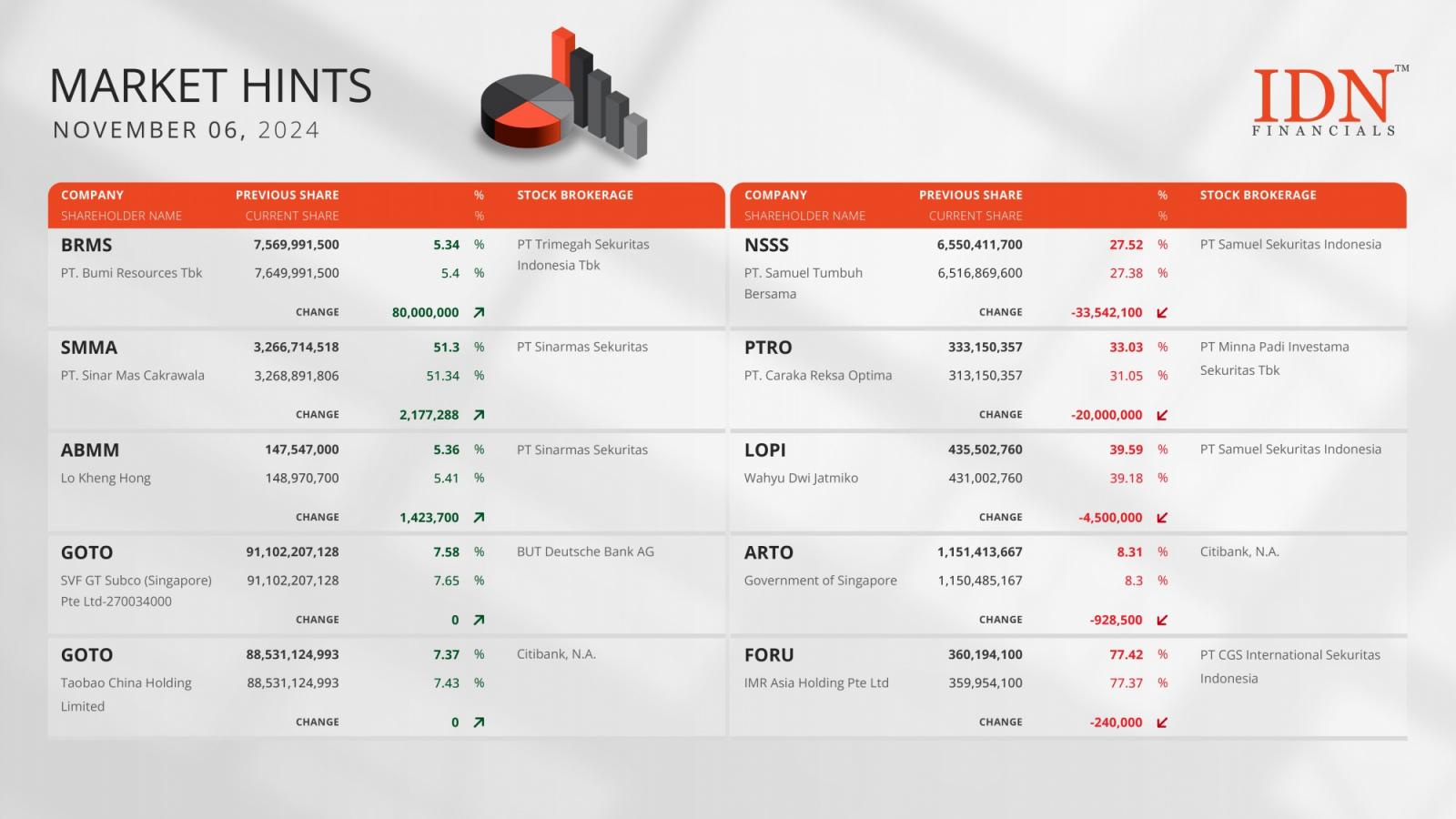

Bumi Resourcesは再び、Bumi Resources Mineral (BRMS)の8000万株を購入

【ジャカルタ】鉱物採掘部門に従事する会社、PT Bumi Resources Minerals Tbk (BRMS)の親会社、PT Bumi Resources Tbkは2024年11月6日(水)にPT Trimegah Sekuritas Indonesia Tbkを通じて、BRMSの8000万株を購入した後、BRMSの所有権は5.34%の以前から5.4%に伸びた。

なお、金融サービス提供者、PT Sinar Mas Multiartha Tbk (SMMA)の支配株主、PT Sinar Mas CakrawalaはSMMAの217万株を購入した。Lo Kheng Hong氏は採炭会社、PT ABM Investama Tbk (ABMM)の142万株を購入した。

電子商取引プラットフォームや金融サービスや運輸サービスなどデジタルサービスを提供する持ち株会社、PT Goto Gojek Tokopedia Tbk (GOTO)の2名の外国投資家は伸びた所有権を記録したが、その株数 は変わらなかった。GOTOの911億株を持つSVF GT Subco (Singapore) Pte Ltd-270034000は7.58%株の以前から7.65%に伸びたGOTOの所有権を記録した。そして、GOTOの885.3億株を持つTaobao China Holding Limitedは7.37%の以前から7.43%に伸びたGOTOの所有権を記録した。

一方、PT Samuel Tumbuh Bersamaは再び、パーム油を生産する会社、PT Nusantara Sawit Sejahtera Tbk (NSSS)の3354万株を売却した。PT Caraka Reksa Optimaは採掘・インフラ・石油ガス会社、PT Petrosea Tbk (PTRO)の2000万株を売却した。

なお、個人投資家、Wahyu Dwi Jatmiko氏は国内外貨物運送業者、PT Logisticsplus International Tbk (LOPI)の450万株を売却した。そして、シンガポール政府は再び、デジタル銀行業会社、PT Bank Jago Tbk (ARTO)の928,500株を売却した。最後に、IMR Asia Holding Pte Ltdはマーケティング・広告通信サービスを提供する会社、PT Fortune Indonesia Tbk (FORU)の240,000株を売却した。 (NR/KD)

IDNFinancialを通じて、マーケットヒントに関する最新情報をご覧下さい!