Foreign purchases are low, and net foreign volume slips back into negative territory

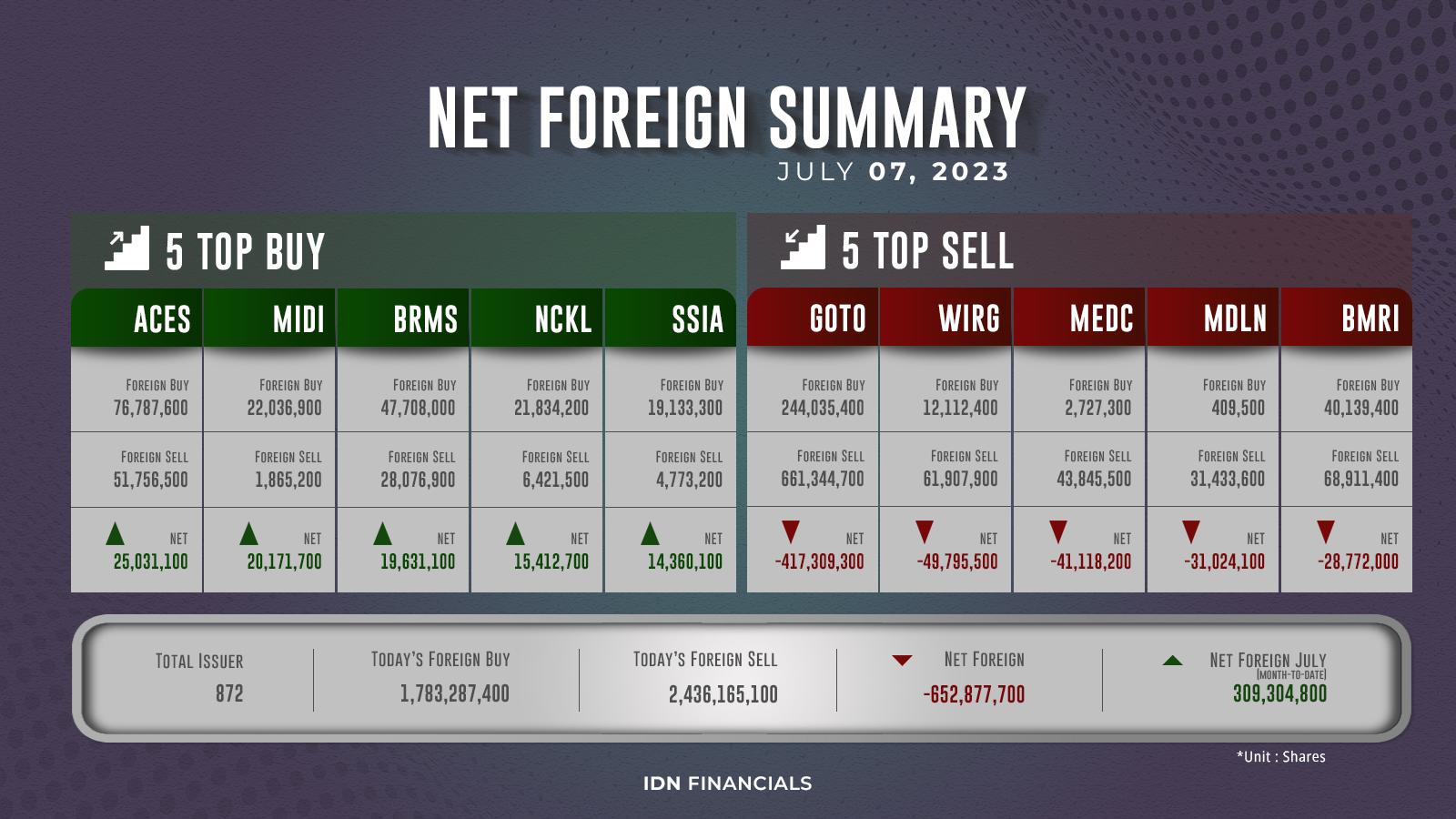

JAKARTA - In comparison to previous exchange days, the volume of foreign purchases on Friday, July 7, was quite low. Foreign investors only purchased approximately 1.78 billion shares, while more than 2.43 billion shares were sold. As a result, foreign net volume fell back into negative territory, with -652,877,700 shares. PT GoTo Gojek Tokopedia Tbk (GOTO), an on-demand service provider technology company, once again became the most released stock by foreigners, with 661.34 million shares and the lowest net volume of -417.30 million. The highest net volume was then recorded by PT Ace Hardware Indonesia Tbk (ACES), a home improvement retailer, with 25.03 million shares after its 76.78 million shares were acquired by foreign investors.

GOTO was followed by PT Wir Asia Tbk (WIRG), a tech company that had a net volume of nearly -50 million shares and a sales volume of 61.90 million shares. PT Medco Energi Internasional Tbk (MEDC), an oil and gas exploration company, then reported a net volume of -41.11 million shares after foreign investors sold 43.84 million shares without purchasing a significant amount. They also sold as many as 31.43 million shares of the property company, PT Modernland Realty Tbk (MDLN). Because the volume of MDLN shares purchased was minuscule, only around 400 thousand shares, the net volume closed at -31.02 million. Finally, foreign investors dumped 68.91 million shares of PT Bank Mandiri (Persero) Tbk (BMRI), but the net volume was only -28.77 million.

Meanwhile, retail company Alfamidi, PT Midi Utama Indonesia Tbk (MIDI), and mineral mining company PT Bumi Resources Minerals Tbk (BRMS) recorded net volumes of approximately 20 million shares, despite foreign investors purchasing approximately 22 million MIDI shares and more than 47 million BRMS shares. Furthermore, nickel mining company PT Trimegah Bangun Persada Tbk (NCKL) and industrial area developer PT Surya Semesta Internusa Tbk (SSIA) achieved a net volume of around 15 million shares. The two issuers made nearly identical foreign purchases, totaling 21.83 million NCKL and 19.13 million SSIA. (KD)

IDNFinancials has the most recent net foreign news!