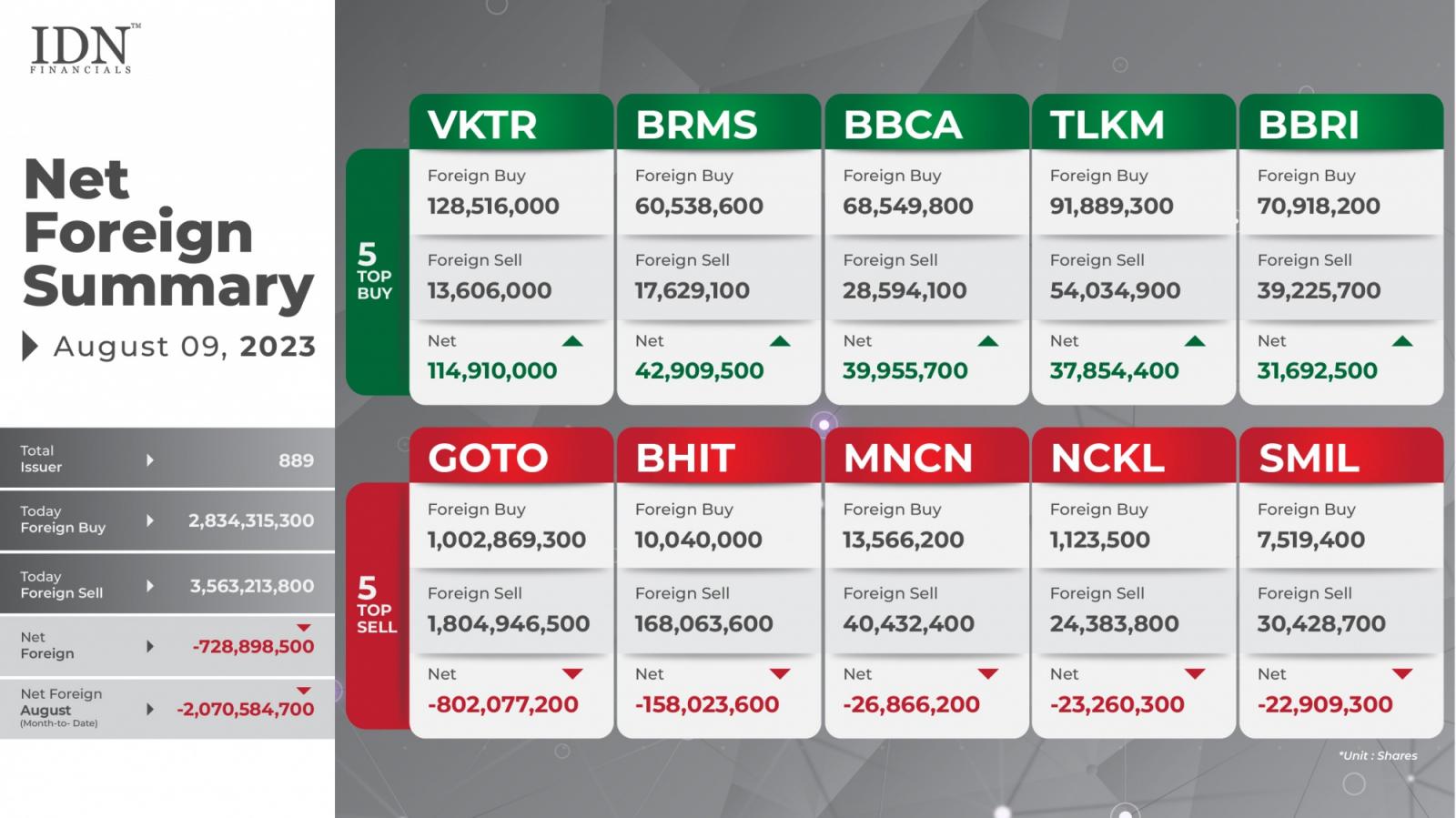

Foreign sales increase: net foreign volume remains negative by 728 million shares

JAKARTA - Foreign sales volume increased to 3.56 billion shares on Wednesday, August 9, after successfully breaking the 3 billion mark on the previous exchange day. With only 2.83 billion in foreign purchases, the net foreign volume closed at -728,898,500 shares. PT GoTo Gojek Tokopedia Tbk (GOTO) recorded the lowest net volume this time, around -802.07 shares. Foreign investors apparently sold over 1.80 billion GOTO shares. Meanwhile, foreigners purchased shares in the electric vehicle manufacturer PT VKTR Teknologi Mobilitas Tbk (VKTR), as many as 128.51 million shares, with the net volume reaching 114.91 million.

PT MNC Asia Holding Tbk (BHIT), the parent company of MNC Group, trailed GOTO with a net volume of -158.02 million, as foreign investors sold 168.06 million shares of BHIT without purchasing many. PT Media Nusantara Citra Tbk (MNCN), one of the MNC Group's subsidiaries, then reported foreign sales of 40.43 million with a net volume of around -26.86 million shares. Foreign investors also released around 24.38 million shares of nickel mining company PT Trimegah Bangun Persada Tbk (NCKL) and 30.42 million shares of forklift rental company PT Sarana Mitra Luas Tbk (SMIL), and both ended up with the same net volume of around -23 million shares.

PT Bumi Resources Minerals Tbk (BRMS), on the other hand, achieved a net volume of 42.90 million shares, followed by private bank PT Bank Central Asia Tbk (BBCA), which recorded nearly 40 million shares. The figures resulted from foreign investors purchasing around 60.53 million BRMS and 68.54 million BBCA shares. The top buy list was then closed by two SOEs: PT Telkom Indonesia (Persero) Tbk (TLKM) and the national bank, PT Bank Rakyat Indonesia (Persero) Tbk (BBRI). These two issuers' foreign purchase volumes were roughly 91.88 million TLKM and 70.91 million BBRI shares, with net volumes of 37.85 million and 31.69 million, respectively. (KD)

Read the most recent foreign investment news at IDNFinancials!