Maybank facilitates digital gold investment, collaborates with Pegadaian to open gold savings

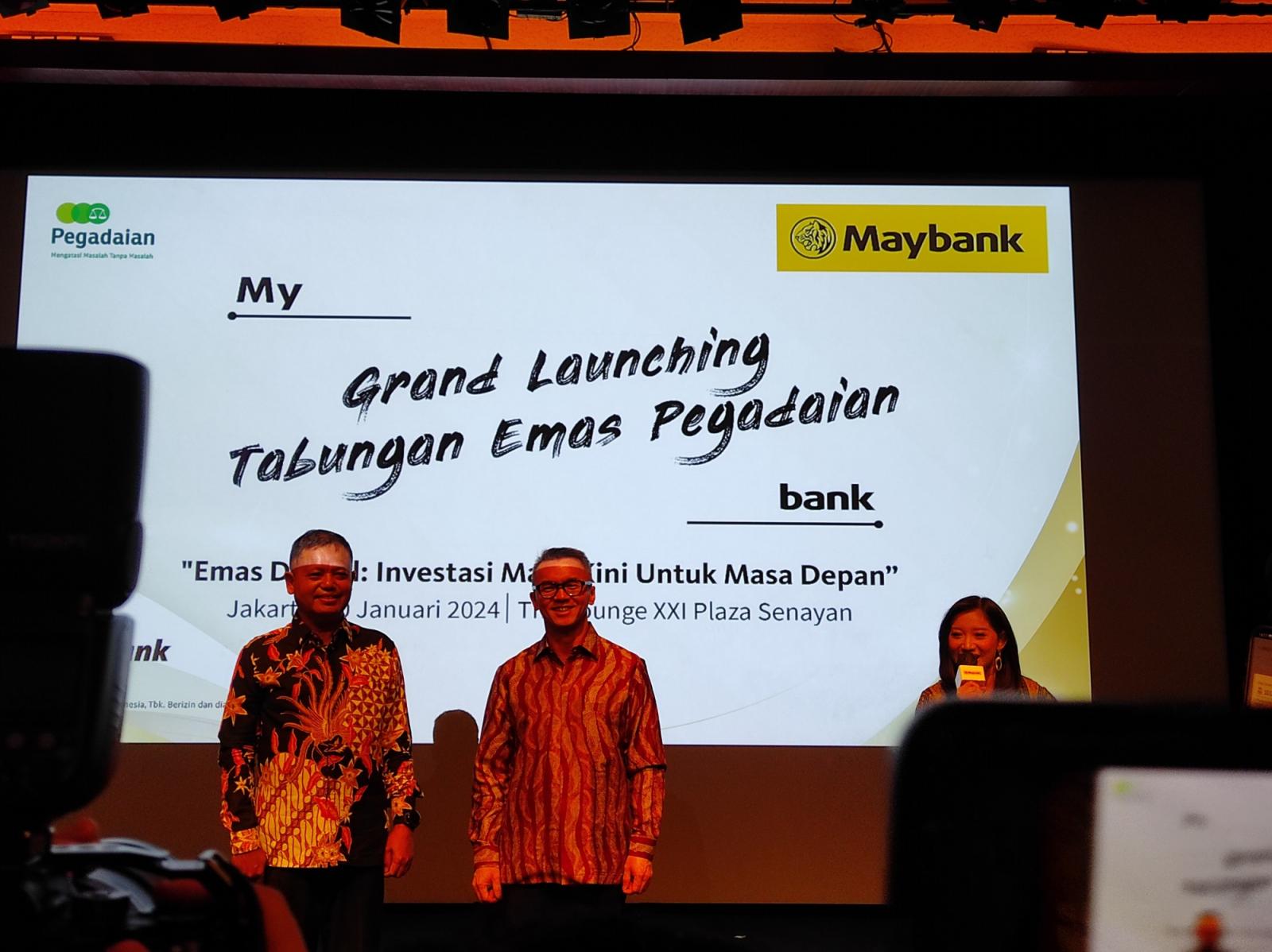

JAKARTA - PT Bank Maybank Indonesia Tbk (BNII), known as Maybank, is now collaborating with Pegadaian to introduce the results of its newest collaboration, namely Pegadaian Gold Savings on the M2U ID App, a mobile banking application from Maybank.

Through its newest feature, Maybank offers a digital way to invest in gold for its customers who want to diversify their investment portfolio into gold.

Based on the 2023 Jakpat survey, gold is said to still be the main investment choice, because its price is resistant to inflation and economic fluctuations.

However, according to Charles Budiman, Chief of Digital Banking Maybank Indonesia, behavioral trends in gold investment are now shifting to prioritizing convenience.

"Well, this digital service will help facilitate gold investment easily," added Budiman when giving a speech at the Press Conference for the Launch of Pegadaian Gold Savings at Maybank today (30/1).

Purchasing gold at Pegadaian Gold Savings on the M2U ID App can start from IDR 10,000. "This gold investment is suitable for beginner investors," added Ferry Hariawan, Senior Vice President of Pegadaian's Innovation Center.

According to Hariawan, demand for gold in Indonesia is actually still low. Penetration of gold investment to the public is a challenge in itself. "One of them is assisted through collaboration with banks," he continued.

From Maybank's perspective, the company admits that banks cannot now work alone in providing investment alternatives. "Banks must cooperate with third parties, and one that can be trusted is Pegadaian," said Budiman.

According to Mulyono, Chief Transformation Office of Pegadaian, Pegadaian's own gold savings was launched in 2015. By 2023, gold savings customers have reached 7 million with gold savings of up to 8 tons.

"Gold is a hedge and can withstand inflation. So, we need a safe asset like gold," added Mulyono. (ZH/LM)