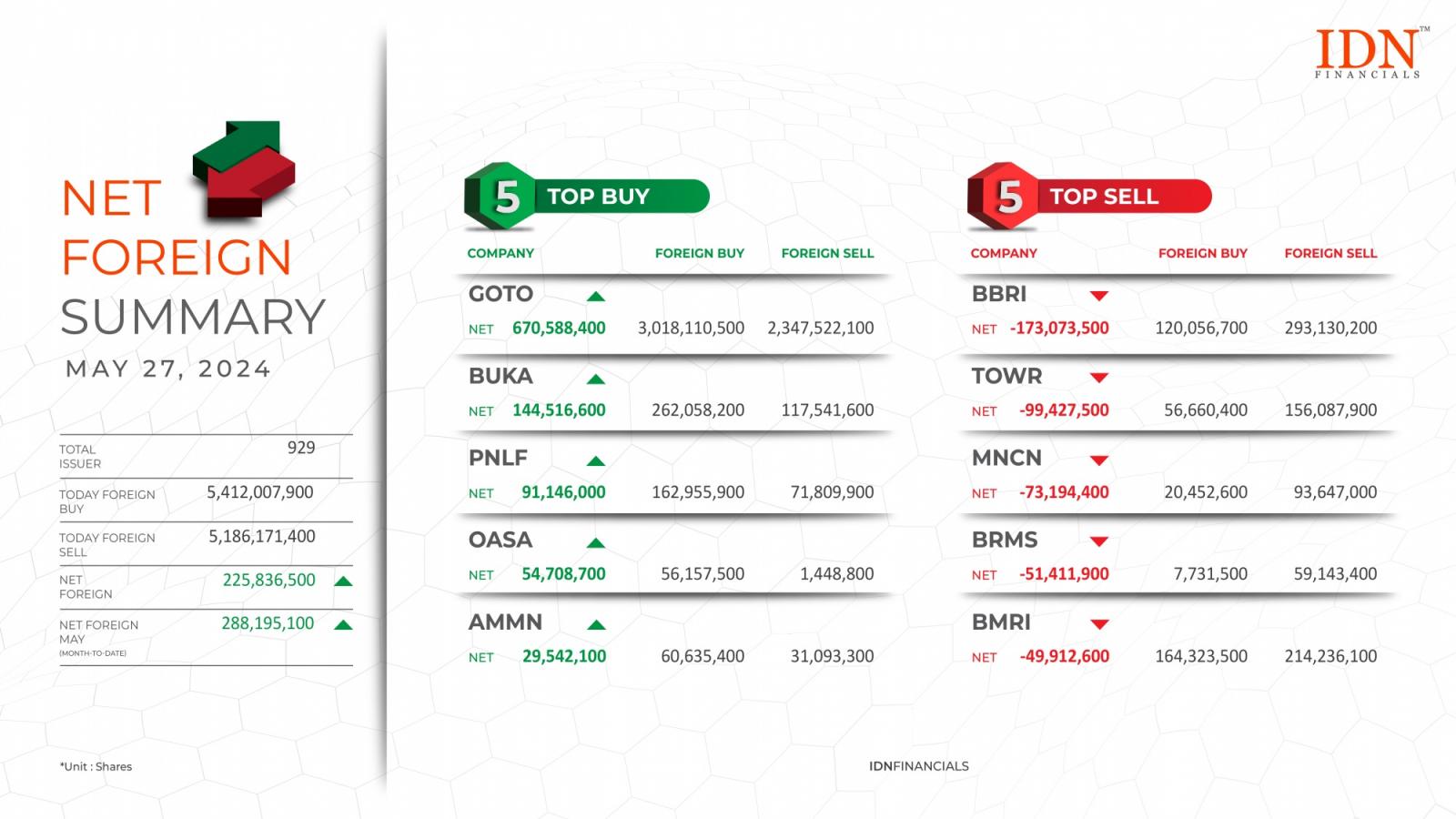

Foreign trading volumes hit 5 billion shares; net foreign volume closed at 225.83 million

JAKARTA - On Monday, May 27, foreign investors bought a total of 5.41 billion shares. Moreover, the foreign sales volume was also fairly comparable, at 5.18 billion shares. As a result, net foreign volume ended at 225.83 million shares. The digital company PT GoTo Gojek Tokopedia Tbk (GOTO) had the most shares purchased by foreign investors, with 3.01 billion shares purchased for a net volume of 670.58 million.

In the e-commerce sector, foreign investors purchased 262.05 million shares of PT Bukalapak.com Tbk (BUKA), for a net volume of 144.51 million shares. The shares of the consulting and investment company PT Panin Financial Tbk (PNLF) were then purchased for 162.95 million shares, with a net volume of 91.14 million shares, followed by the purchase of 56.15 million shares of the renewable energy company PT Maharaksa Biru Energi Tbk (OASA), with a net volume of 54.70 million. Around 60.63 million shares of PT Aneka Tambang Tbk (ANTM), which engages in the precious metal mining sector, were also purchased, for a net volume of 29.54 million shares.

Meanwhile, shares of the banking company PT Bank Rakyat Indonesia (Persero) Tbk (BBRI) were sold for 293.13 million, with a net volume of -173.07 million shares. In the same sector, shares of PT Bank Mandiri (Persero) Tbk (BMRI) were sold for 214.23 million, with a net volume of -49.91 million shares. The shares of the investor company in the field of operating telecommunications towers, PT Sarana Menara Nusantara Tbk (TOWR), were then sold for 156.08 million shares, and the net volume was -99.42 million shares. Apart from that, about 93.54 million shares of the media company PT Media Nusantara Citra Tbk (MNCN) were sold by foreign investors, with a net volume of -73.19 million shares. Finally, PT Bumi Resources Minerals Tbk (BRMS) shares in the mineral mining sector were sold for 59.14 million, resulting in a net volume of -51.41 million. (KD)

Find the latest net foreign news only at IDNFinancials!