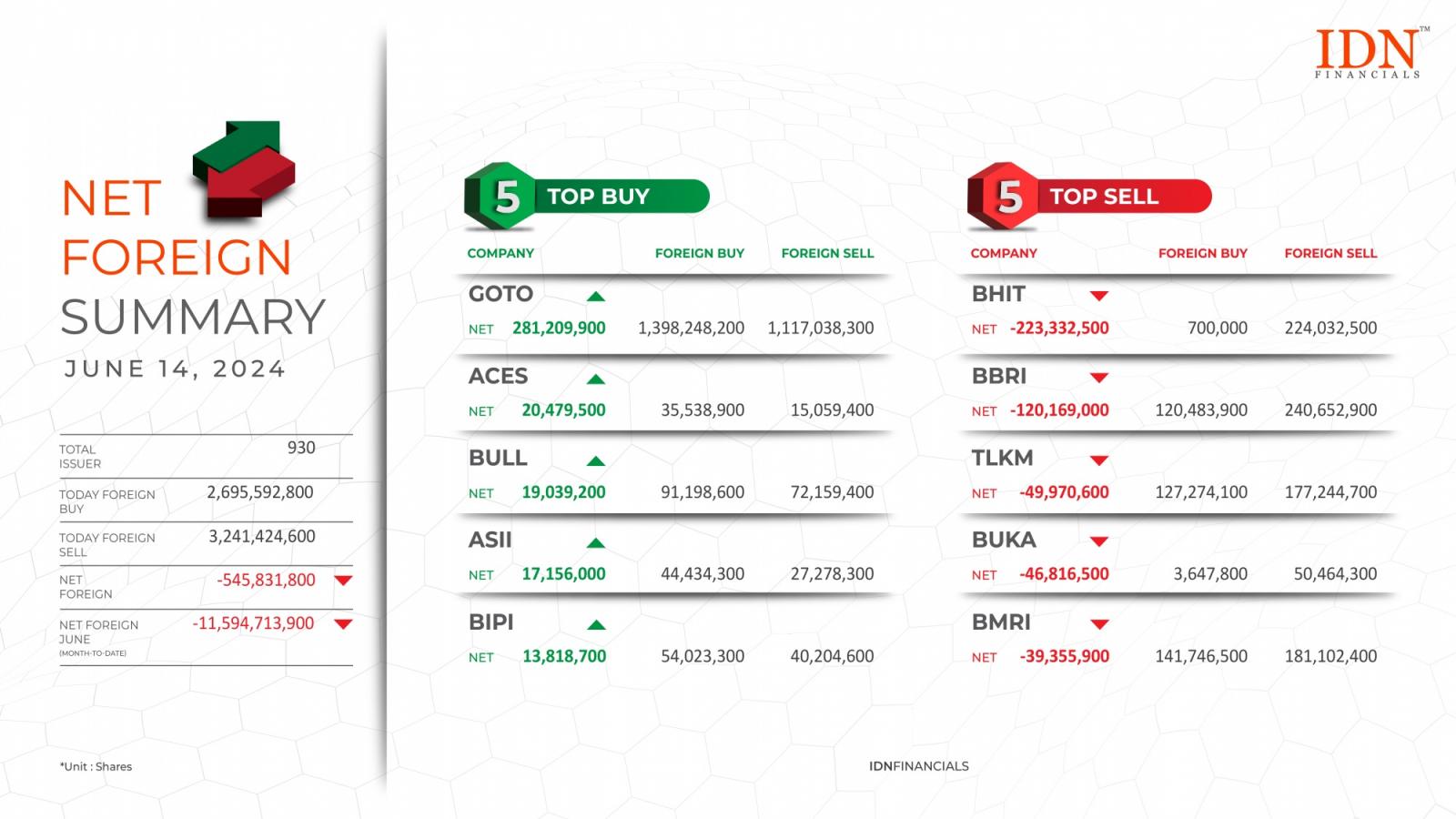

3.24 billion shares of foreign sell volume resulted in net foreign of -545.83 million shares

JAKARTA - Foreign share sales on Friday, June 14, generated a foreign selling volume of 3.24 billion shares. Meanwhile, foreign buying volume was only around 2.69 billion shares, leaving net foreign volume at -545.83 million shares. Unlike the previous day, shares of digital company PT GoTo Gojek Tokopedia Tbk (GOTO) were the most acquired this day, totaling 1.39 billion shares with a net volume of 281.20 million.

Furthermore, 35.53 million shares of PT Ace Hardware Indonesia Tbk (ACES), a household products retail company, were purchased, for a net volume of 20.47 million shares. Shares of PT Buana Lintas Lautan Tbk (BULL), which provides domestic and international shipping services, were then purchased for 91.19 million shares, for a net volume of 19.03 million shares. In the automotive industry, foreign investors purchased 44.43 million shares of PT Astra International Tbk (ASII), for a net amount of 17.15 million shares. In addition, approximately 54.02 million shares of PT Astrindo Nusantara Infrastruktur Tbk (BIPI) were purchased, for a net volume of 13.81 million shares.

On the top-selling list, foreign investors sold 224.03 million shares of the securities company PT MNC Asia Holding Tbk (BHIT), for a net volume of -223.33 million shares. In the banking sector, PT Bank Rakyat Indonesia (Persero) Tbk (BBRI) shares were sold for 240.65 million shares, with a net volume of -120.16 million shares. This was followed by the sale of 181.10 million shares of PT Bank Mandiri (Persero) Tbk (BMRI) in the same sector, with a net volume of -39.35 million. Shares of PT Telkom Indonesia (Persero) Tbk (TLKM), a state-owned telecommunications company, were then sold for 177.24 million shares, with a net volume of -49.97 million. Finally, shares of the e-commerce company PT Bukalapak.com Tbk (BUKA) were sold for 50.46 million shares, resulting in a net volume of -46.81 million shares. (KD)

Find the most recent net foreign news exclusively from IDNFinancials!