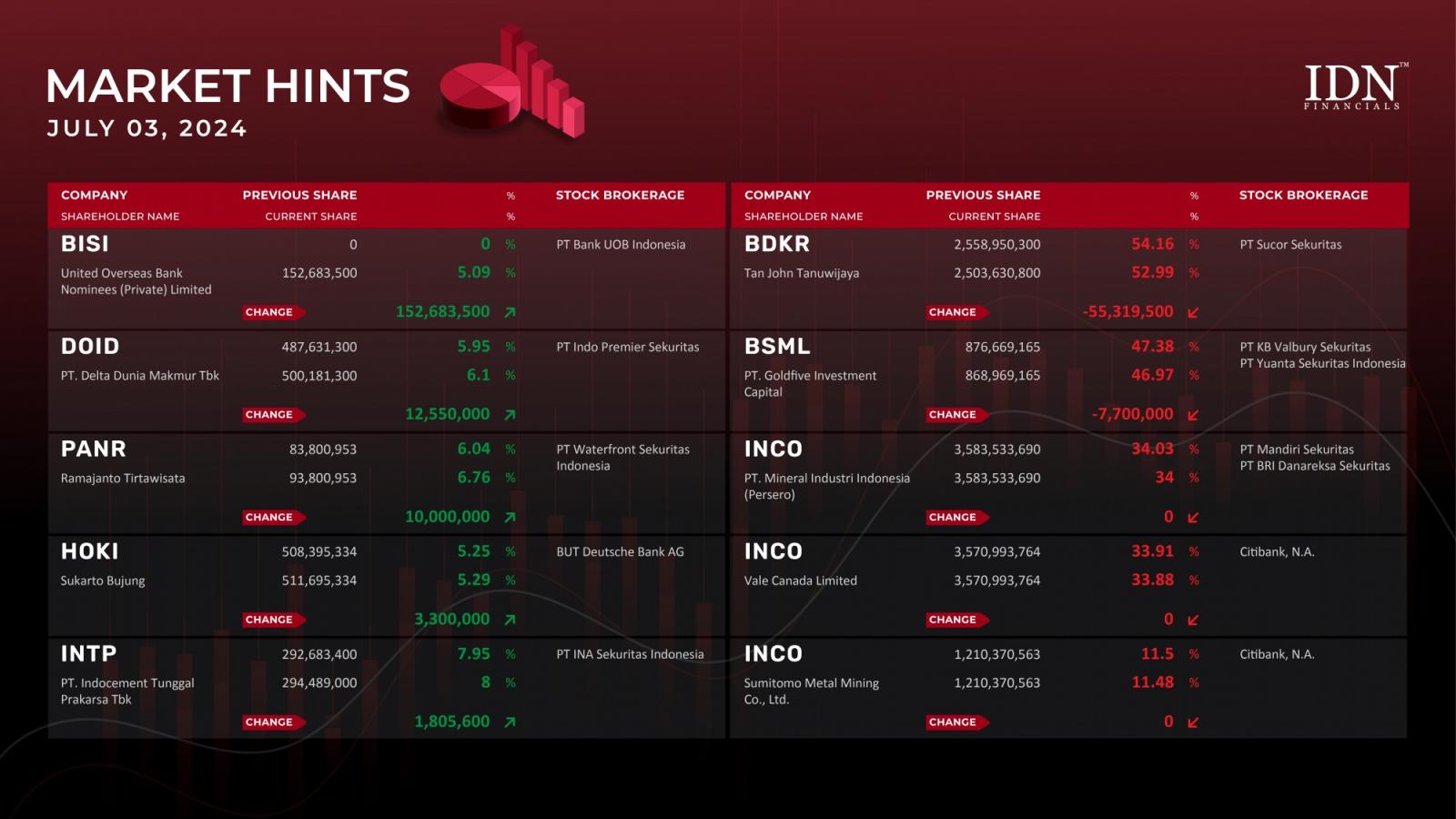

Three Vale Indonesia (INCO) investors reported decline in share portion

JAKARTA - As a result of PT Vale Indonesia Tbk's (INCO) divestment, three of its largest investors saw a decrease in share portion but no change in the number of shares owned on Wednesday, July 3. The state-owned company PT Mineral Industri Indonesia (Persero), which owns 3.58 billion shares in this nickel mining company, saw its share percentage fell from 34.03% to 34%. Then, foreign investor Vale Canada Limited saw its share portion fall from 33.91% to 33.88% of the 3.57 billion shares it owned. Finally, Sumitomo Metal Mining Co., Ltd., another foreign investor with 1.21 billion shares, saw a decrease in share ownership from 11.5% to 11.48.

Tan John Tanuwijaya once again reduced his stake in PT Berdikari Pondasi Perkasa Tbk (BDKR), which specializes in foundation construction, by selling 55.31 million shares. PT Goldfive Investment Capital also sold 7.70 million shares of PT Bintang Samudera Mandiri Lines Tbk (BSML), a maritime shipping and logistics services issuer.

Meanwhile, foreign investor United Overseas Bank Nominees (Private) Limited has become the most recent investor in PT BISI International Tbk (BISI), which operates in the agricultural sector. This investor now owns 5.09% of all BISI shares after purchasing 152.68 million of them. Ramajanto, an individual investor in the tourism industry issuer PT Panorama Sentrawisata Tbk (PANR), then added another 10 million shares, while Sukarto Bujung purchased an additional 3.30 million shares in the premium rice processing and distribution company PT Buyung Poetra Sembada Tbk (HOKI). Finally, PT Delta Dunia Makmur Tbk (DOID) and PT Indocement Tunggal Prakarsa Tbk (INTP) continued to buy back shares, this time for 12.55 million DOID and 1.80 million INTP shares. (KD)

Read the most recent market hints only at IDNFinancials!