Investors' share portion shifts as Bank Neo holds rights issue

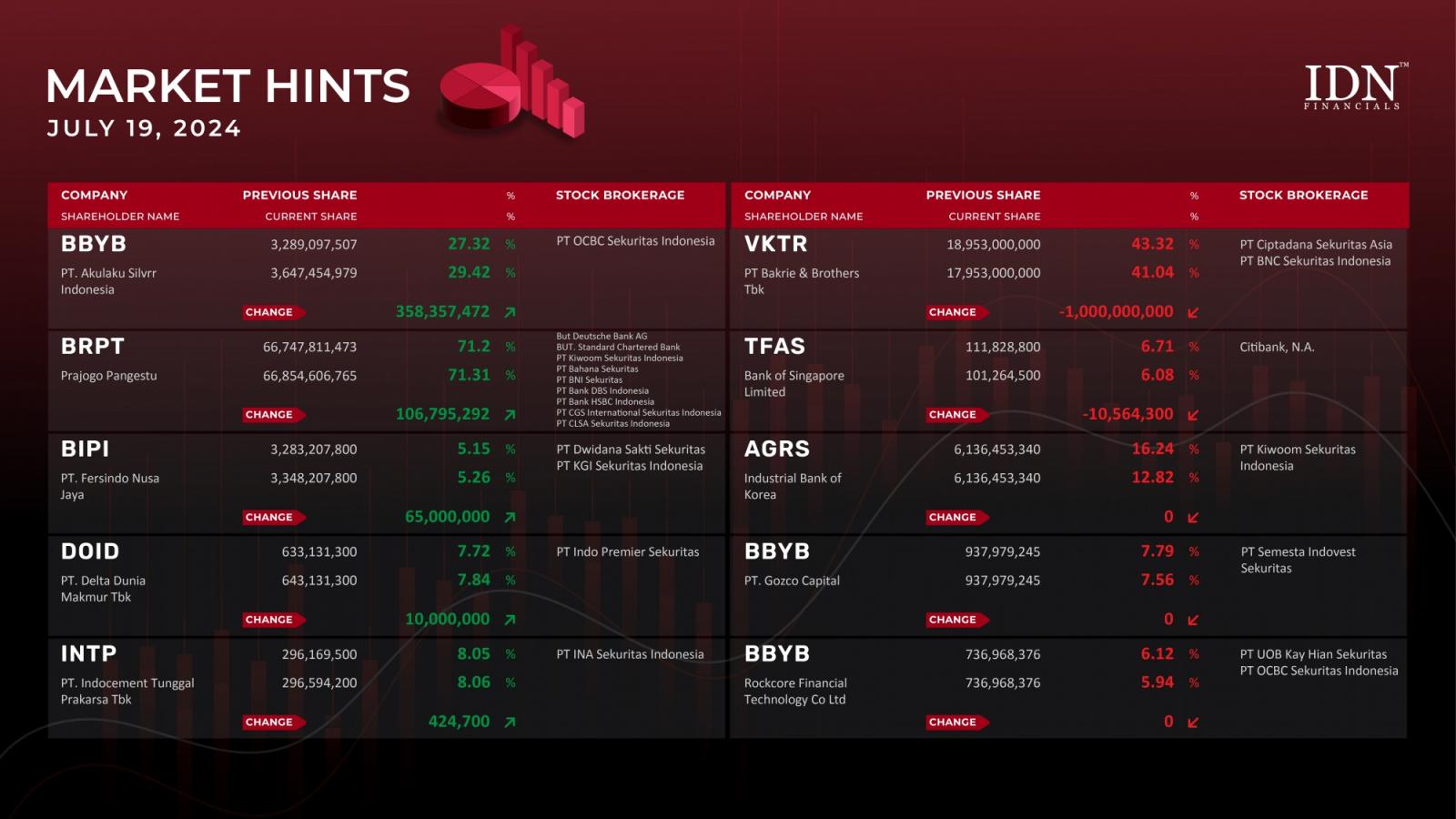

JAKARTA - This July, PT Bank Neo Commerce Tbk (BBYB), a banking company, held a rights issue that changed the share portion held by a number of its major investors. PT Akulaku Silvrr Indonesia gained 358.35 million shares on Friday, July 19, increasing its share portion from 27.32% to 29.42%. As PT Gozco Capital did not take part in the rights issue, its share volume decreased from 7.79% to 7.56% even though it still had 937.97 million shares. Foreign investor Rockcore Financial Technology Co. Ltd., who held 736.96 million BBYB shares, went through a similar situation. It was noted that the share portion had dropped from 6.12% to 5.94%.

Additionally, through nine separate securities companies, Prajogo Pangestu purchased 106.79 million shares of the energy and industrial company PT Barito Pacific Tbk (BRPT). This controller possesses 66.85 billion shares, or roughly 71.31% of the total shares. Additionally, PT Fersindo Nusa Jaya bought another 65 million more shares, for a total ownership of 5.26%, in the energy infrastructure firm PT Astrindo Nusantara Infrastruktur Tbk (BIPI). In addition, PT Delta Dunia Makmur Tbk (DOID), the mining holding company, and PT Indocement Tunggal Prakarsa Tbk (INTP), the cement producer, have both started another share buyback action with a total of 10 million and 424,700 shares, respectively.

Conversely, by selling one billion shares of the electric vehicle manufacturer, PT VKTR Teknologi Mobilitas Tbk (VKTR), through PT Ciptadana Sekuritas Asia and PT BNC Sekuritas Indonesia, PT Bakrie & Brothers Tbk recorded the largest share reduction this time around. Also, the share portion of this investor decreased from 43.32% to 41.04%. Then, 10.56 million shares of PT Telefast Indonesia Tbk (TFAS), a provider of mobile data outlets and stores, were sold by foreign investor Bank of Singapore Limited. The last update was provided by the Industrial Bank of Korea, which noted a decrease in shares in PT Bank IBK Indonesia Tbk (AGRS) or IBK Global Bank from 16.24% to 12.82% due to the rights issue, without a decrease in the total number of shares. (KD)

Grab the latest market hints only on IDNFinancials!