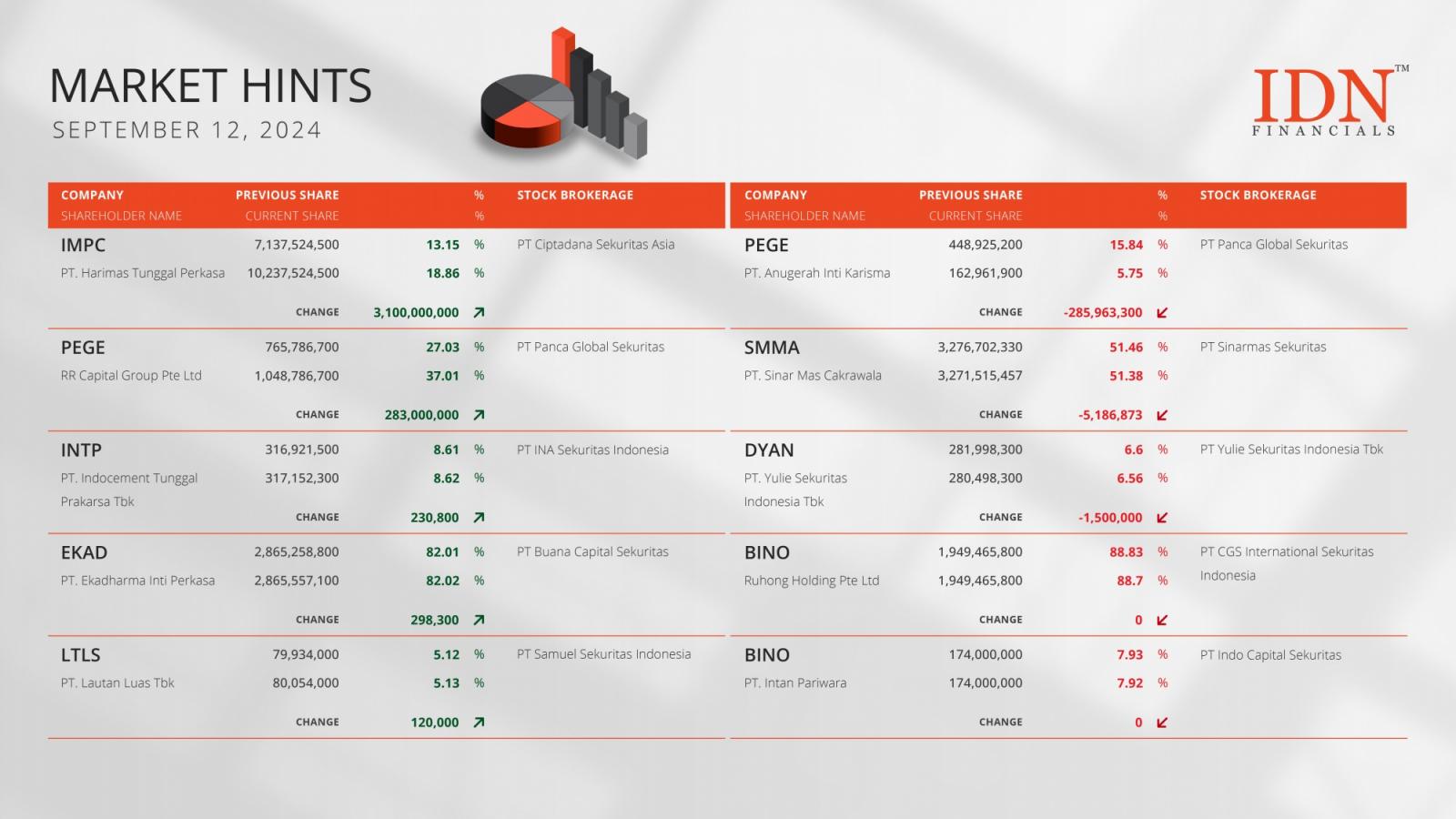

Harimas Tunggal Perkasa acquired 3.1 billion Impack Pratama (IMPC) shares

JAKARTA - PT Harimas Tunggal Perkasa purchased up to 3.1 billion shares of PT Impack Pratama Industri Tbk (IMPC) on Thursday, September 12. With the addition of shares through PT Ciptadana Sekuritas Asia, this investor's share control increased to 18.86% from its previous holdings of approximately 7.13 billion shares, or 13.15% of the stakes. Impack Pratama is a company that produces plastic roofing, ceiling, and wall panels, among other building materials.

The controlling shareholder of PT Ekadharma International Tbk (EKAD), PT Ekadharma Inti Perkasa, then purchased 298,300 shares, making up the final share portion of 82.02% in this company that makes and sells adhesive tape, aluminum foil, cling wrap, and related materials. The next acquisition of shares by the two issuers constituted the buying back of shares. Cement manufacturer PT Indocement Tunggal Prakarsa Tbk (INTP) purchased 230,800 of its own shares, and PT Lautan Luas Tbk (LTLS), a company that imports and distributes chemicals for the food and batik industries, purchased 120 thousand shares.

The following information was provided by PT Panca Global Kapital Tbk (PEGE), an enterprise that deals in securities trading and brokerage. RR Capital Group Pte Ltd, a foreign investor, chose to acquire 283 million PEGE shares in order to increase its stake to 37%. In the meantime, 285.96 million PEGE shares were sold by PT Anugerah Inti Karisma, with the share percentage decreasing from nearly 16% to just 5.75 percent. PT Panca Global Sekuritas handled both of the transactions.

Conversely, PT Yulie Sekuritas Indonesia Tbk decreased its stake in event solutions provider PT Dyandra Media International Tbk (DYAN) by 1.5 million shares, while PT Sinar Mas Cakrawala sold 5.18 million shares of financial services provider PT Sinar Mas Multiartha Tbk (SMMA). Ruhong Holding Pte Ltd and PT Intan Pariwara, two significant investors in PT Perma Plasindo Tbk (BINO), a producer of office supplies under the Bantex brand, then reported the reduction in share percentage once more. Ruhong Holding, with 1.94 billion shares, now owns only 88.7% of BINO, while Intan Pariwara, with 174 million shares, holds 7.92%, all without any reduction in the number of shares at all. (KD)

Read the latest market hints only on IDNFinancials!