Sight Investment gains control of Siloam Hospital through purchase of 5.85 billion shares

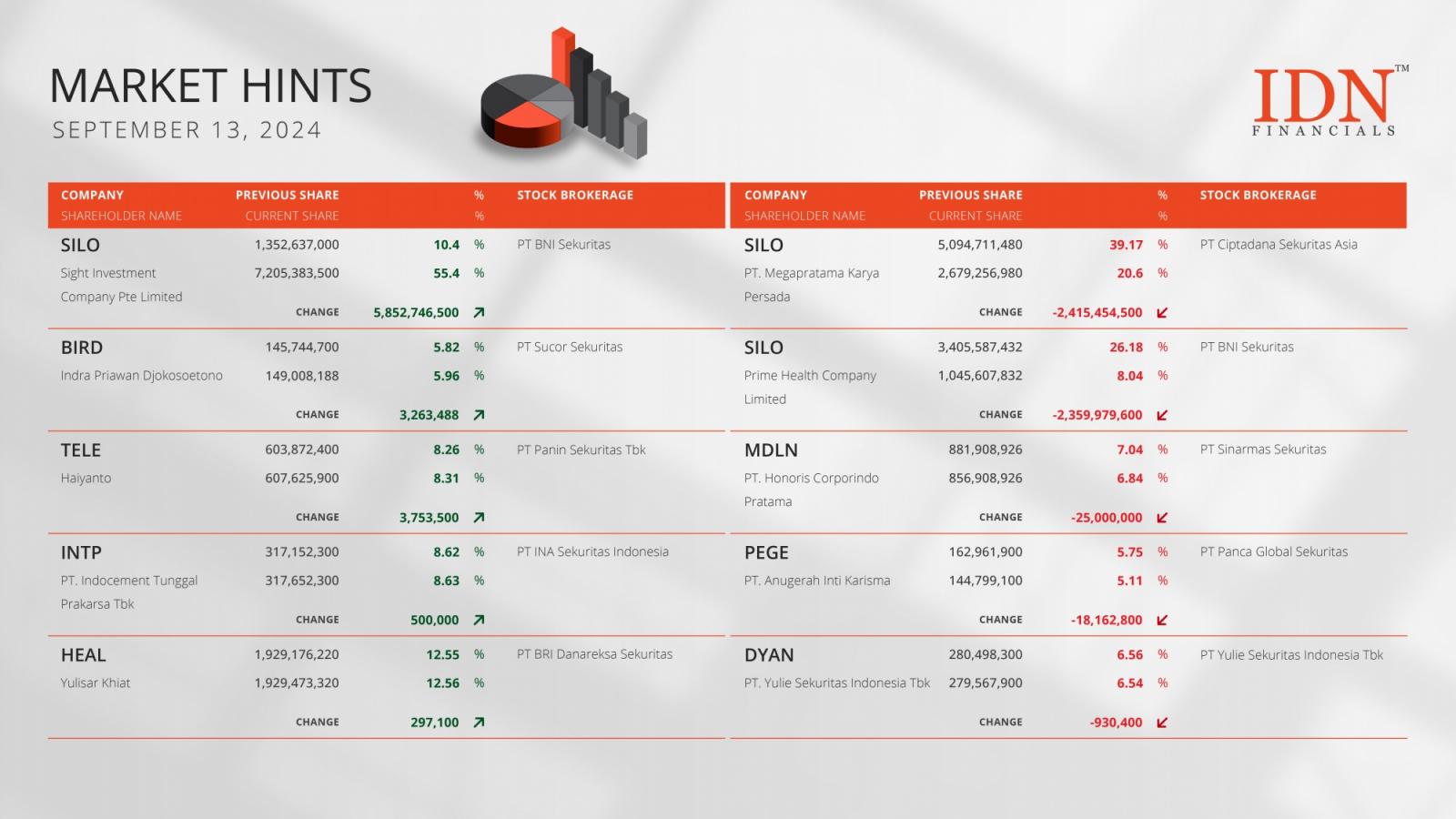

JAKARTA - On Friday, September 13, PT Siloam International Hospitals Tbk (SILO) saw the purchase of over 5.85 billion shares by foreign investor Sight Investment Company Pte Limited, for a total of 7.20 billion shares recorded. Along with this purchase through PT BNI Sekuritas, the foreign investor's ownership increased dramatically from 10.4% to 55.4%. By default, Sight Investment took over as the operator of Siloam Hospital's controlling shareholder.

However, 2.41 billion shares of SILO were actually released by PT Megapratama Karya Persada. Its share portion then decreased from nearly 40% to only roughly half of it. Another foreign investor, Prime Health Company Limited, also participated in the reduction of SILO shares. They sold 2.35 billion shares, resulting in a share decrease of 26.18% to 8.04%.

Individual investor Indra Priawan Djokosoetono then bought a total of 3.26 million shares of PT Blue Bird Tbk (BIRD), a holding company that provides transportation needs, through PT Sucor Sekuritas. Haiyanto also purchased up to 3.75 million shares in PT Omni Inovasi Indonesia Tbk (TELE), the issuer that deals with the retail and distribution of telecommunications products. Next, 297,100 shares of PT Medikaloka Hermina Tbk (HEAL), the company that runs Hermina Hospital, were acquired by Yulisar Khiat. On top of that, PT Indocement Tunggal Prakarsa Tbk (INTP), a producer of cement, purchased 500,000 of its own shares, for a total of 317.65 million shares, or 8.63%.

In contrast, PT Honoris Corporindo Pratama released 25 million shares of the property development company PT Modernland Realty Tbk (MDLN). PT Anugerah Inti Karisma then released 18.16 million shares of PT Panca Global Kapital Tbk (PEGE), an issuer in the securities brokerage and trading industry. Lastly, PT Yulie Sekuritas Tbk was still selling up to 930,400 shares of PT Dyandra Media International Tbk (DYAN), a provider of event organizer solutions. (KD)

Discover more about IDNFinancials' top market hints!