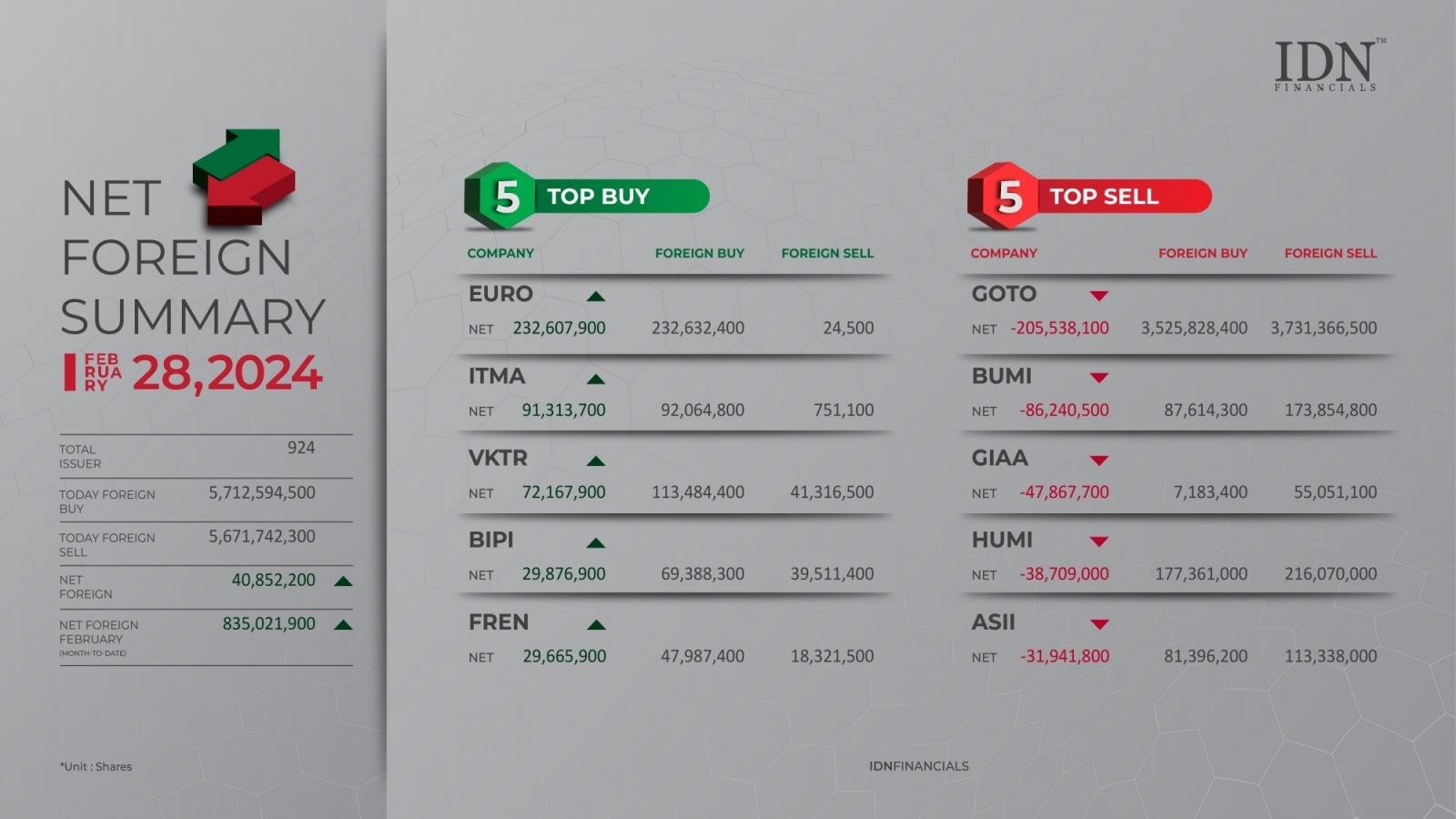

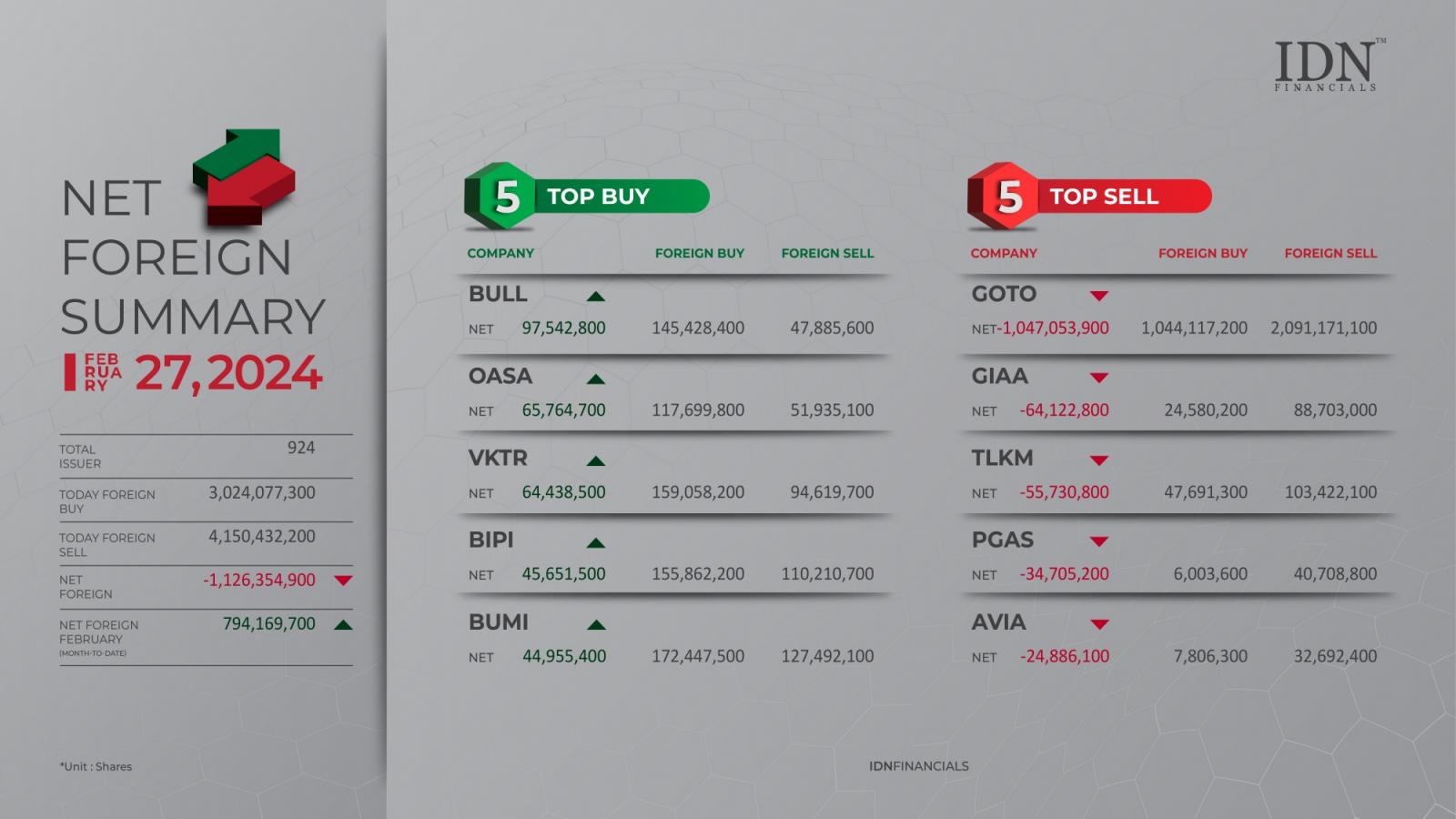

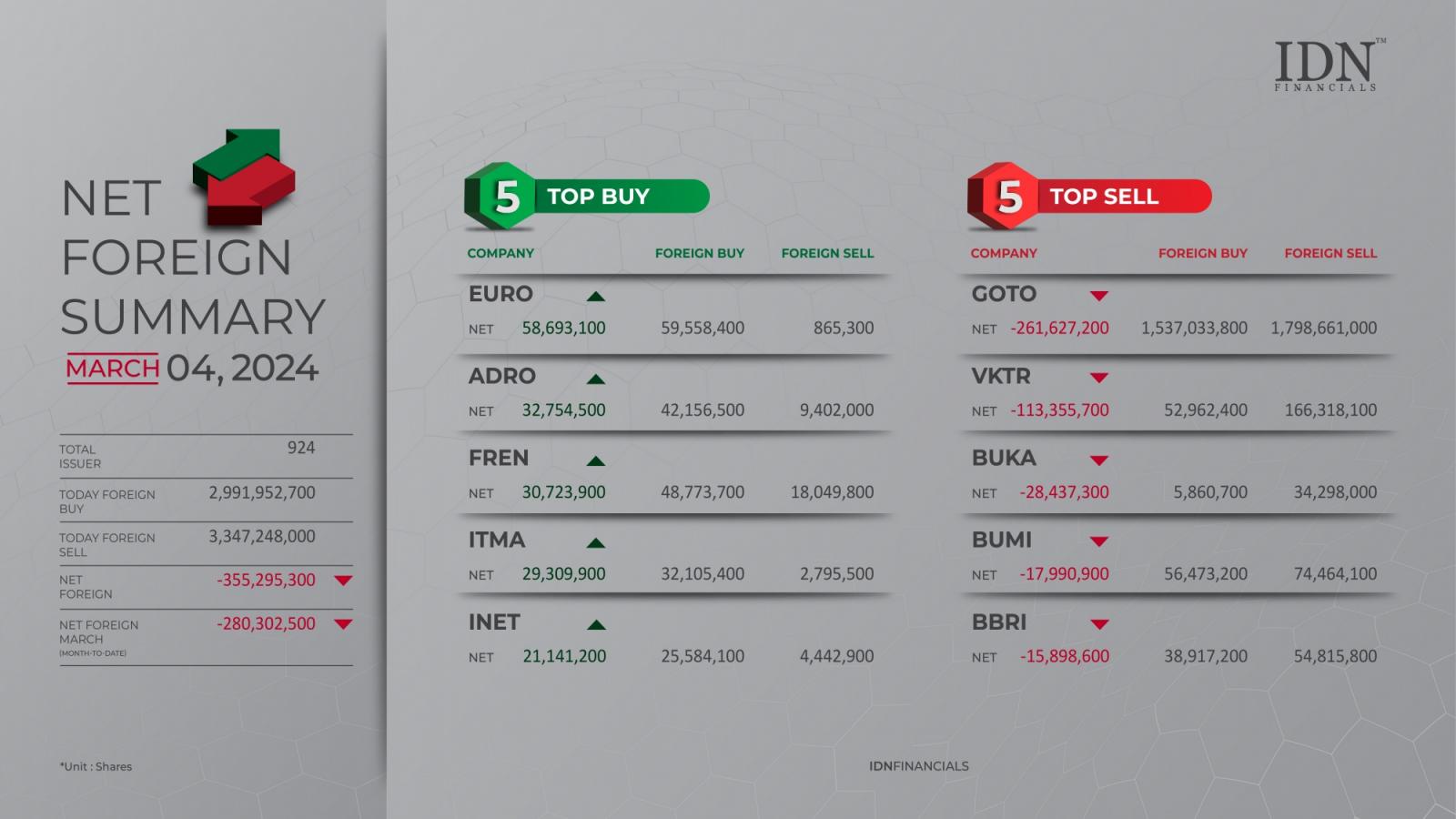

Gojek Tokopedia (GOTO) shares accounted for 53% of foreign sell; net foreign volume is -355.29 million shares

05 Mar 2024 11:19

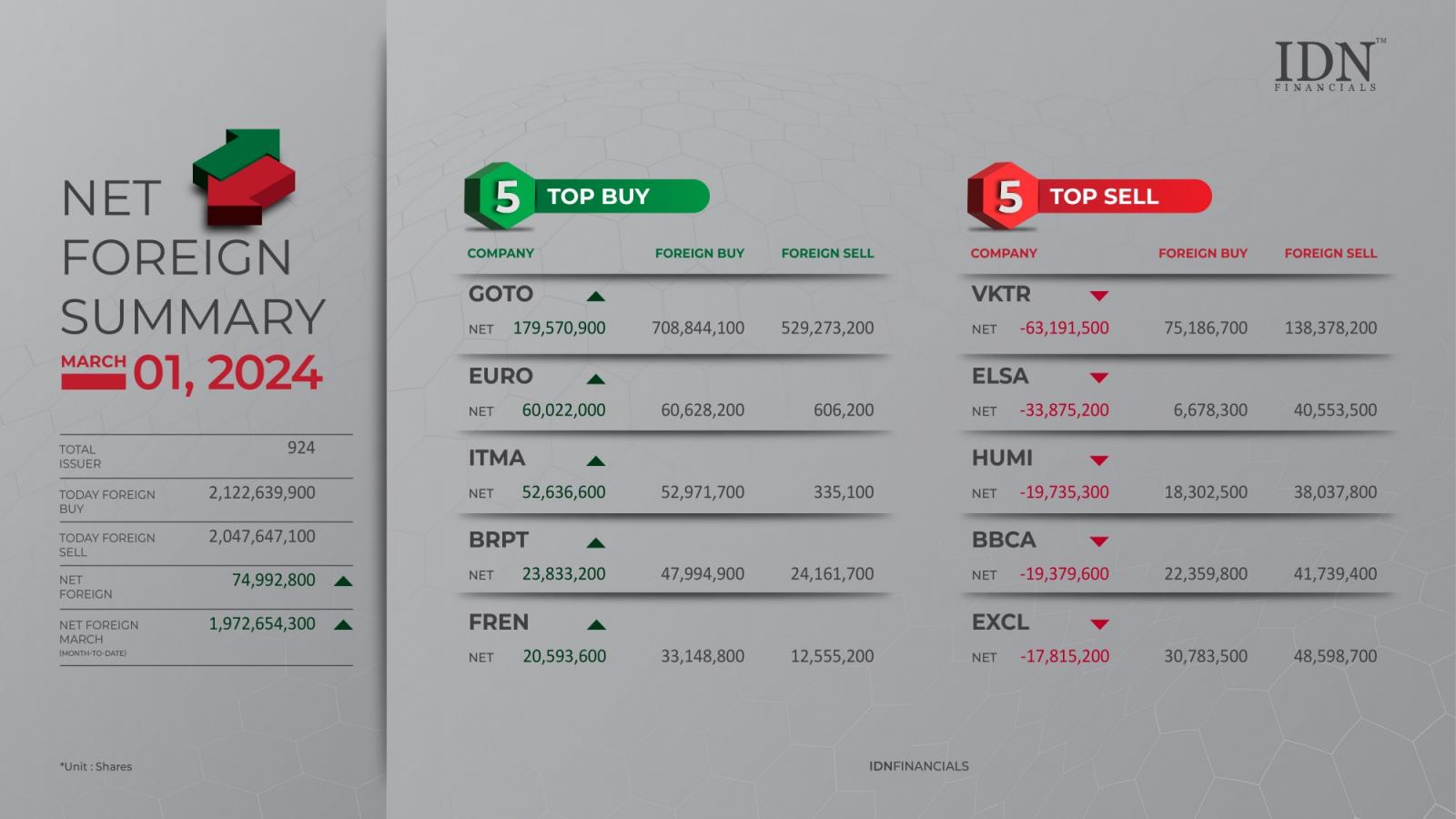

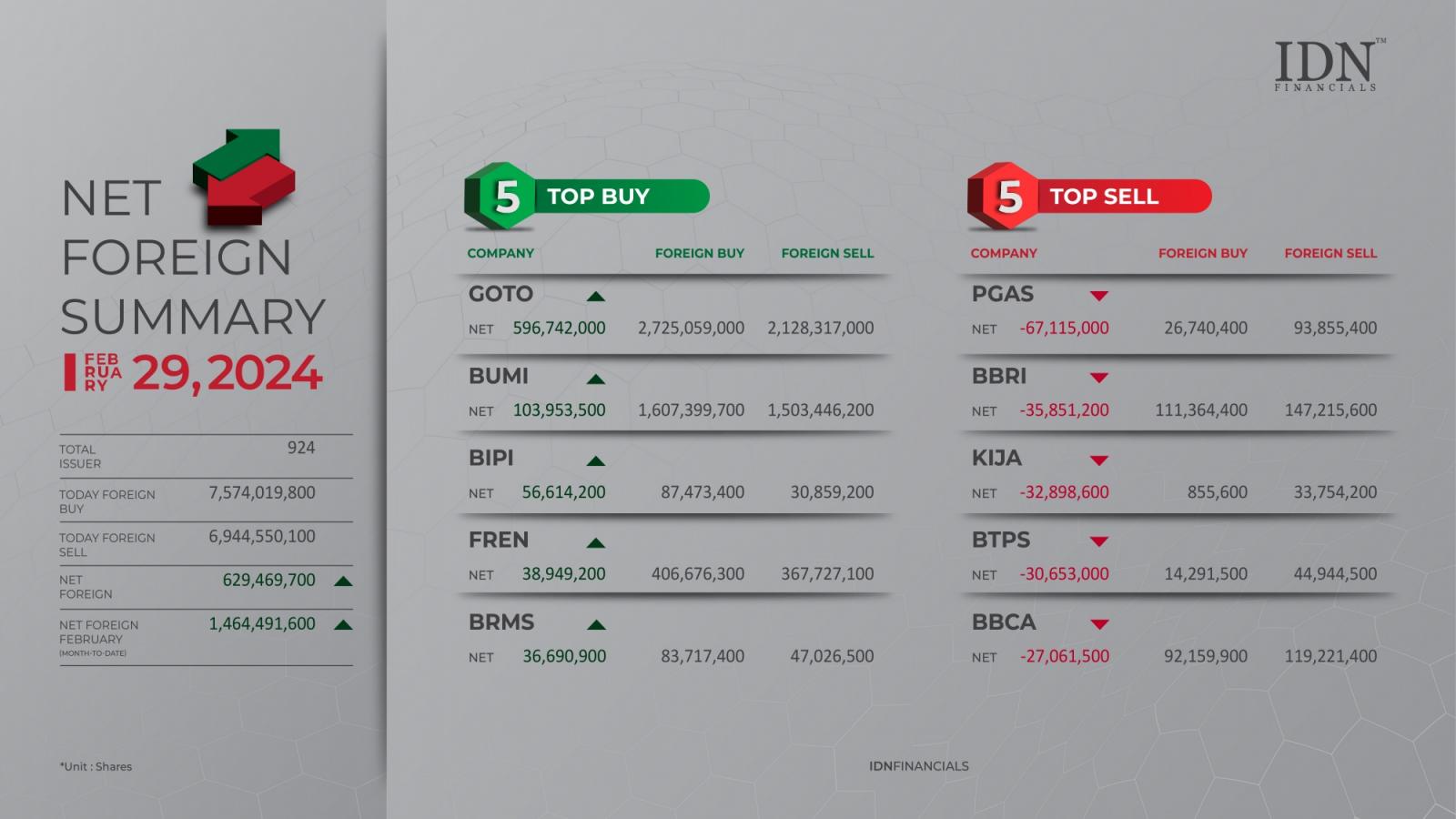

On Monday, March 4, foreign investors were selling large amounts of shares in the digital company PT GoTo Gojek Tokopedia Tbk (GOTO). GOTO shares were sold for 1.79 billion shares, or approximately 53.71% of total foreign sales volume, for a net volume of -261.62 million shares. The foreign sell volume this time was 3.34 billion shares, while the foreign buy was 2.99 billion shares, resulting in a net foreign volume of -355.29 million shares.